We will assist you to Set up your new business in the Dubai free zone

You can get great tax benefits and create a cost-effective platform for conducting businesses and international trade with an offshore company registered in the Dubai free zone.

To have it with minimal accounting obligations and no requirement for annual reporting, along with full tax-exempt status, you can choose to create the equivalent of a company in the cloud. Your wholly-owned limited liability company (LLC) is allowed under Dubai’s free zone regulations to provide goods and services to customers all around the world. Foreigner-owned corporations based in a Dubai free zone can bypass the need in other jurisdictions to operate with heavy administration and financial obligations.

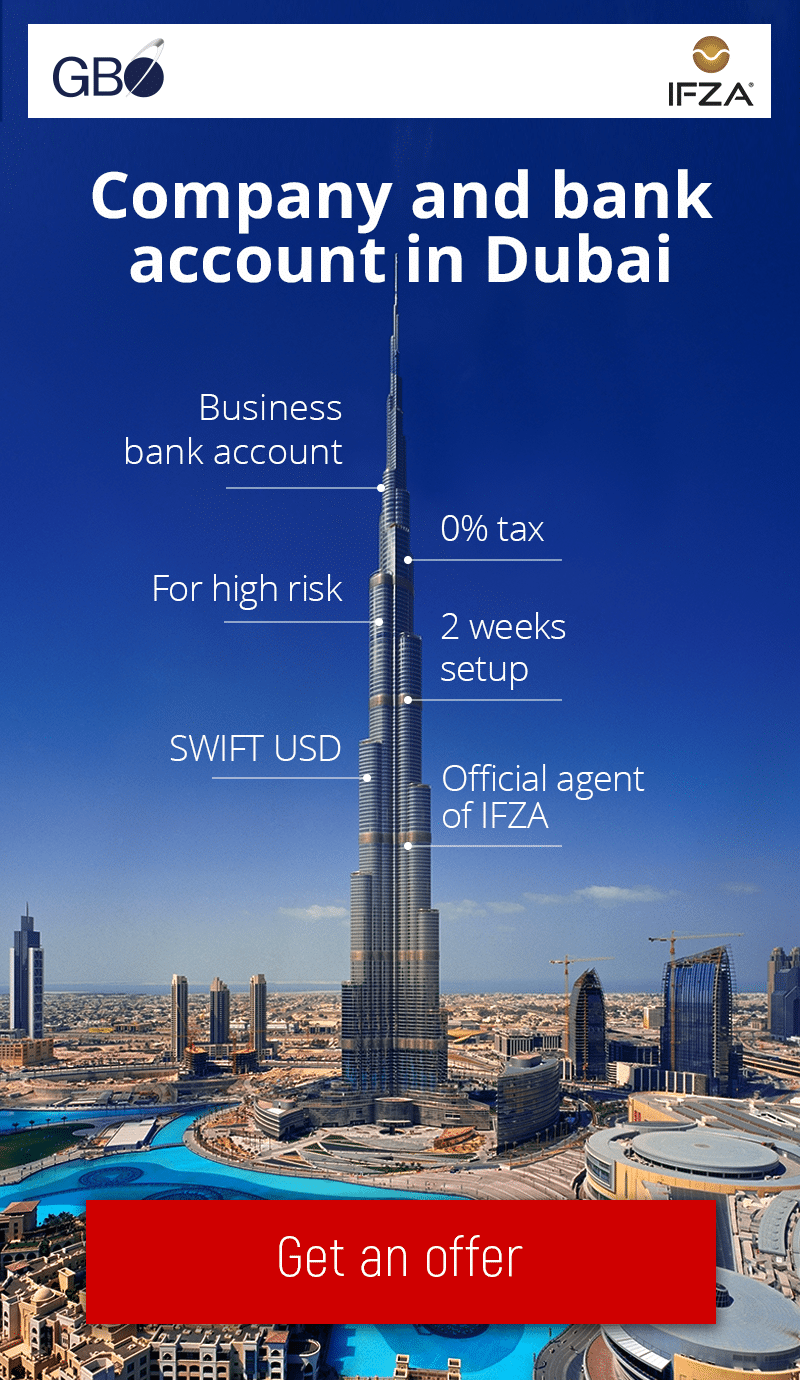

Our team of offshore company formation specialists here at GBO can assist you in all the necessary steps to create the cheapest business setup in a Dubai free zone, including processing applications for investors’ and employees’ visas and negotiations for the opening of corporate bank accounts with banks .

Setup your Dubai company with GBO’s Dubai experts

in**@gb****.com

What are your options for Dubai Free Zone company formation?

Dubai offers investors the choice of multiple free zones, currently numbering more than 40. Fully-owned companies are able to select a free zone that has a specific structure that favours a single form of business. These free zones share attributes the ability for companies to provide their world-wide customers with specific services in their particular lines of business activity.

What are the primary benefits for foreign investors of choosing Dubai to form their company?

● Dubai has its own set of laws and regulations

● Dubai has the most advanced economic business community in the Middle East.

● As a member of the broader UAE economy Dubai provides access to the global market

● Dubai provides a sophisticated and modern infrastructure, with state-of-the-art internet facilities and support.

What are the benefits of operating in a free zone?

● Set-up comes at a reasonable and competitive cost and it is easy to set up a new company

● Companies are completely exempt from corporate tax and customs duties

● Total foreign ownership is permitted

● Total repatriation of capital and profits is allowed

● Many options are available, making it possible to suit multiple business models.

How does a Dubai offshore corporation operate?

Dubai Free Zone offshore companies are allowed to conduct business activities such as international trade, and to provide services. A company can also act as a holding company for investment in companies located in other jurisdictions and countries. It can own real estate and offer international consulting services in other countries. A free zone company can’t conduct business with another UAE corporation, unless it is also located in one of the free zones.

Why select Dubai ahead of other UAE offshore options?

● Dubai’s laws provide for a company to be set up as a properly structured offshore business in a free zone that is legally exempt from corporate taxes. Because UAE is a recognized economic jurisdiction, it means that companies with their residence there are not regarded as being located in a tax avoidance haven.

● Compared to other company options in the UAE, a Dubai free zone company can be set up quickly and at relatively lower cost.

● The shareholders, ultimate beneficial owners (UBOs) and directors of a free zone company in Dubai don’t have to register their private details in official public records.

● A Dubai free zone company is not required to lodge annual accounting reports

● A free zone company in Dubai can pay dividends to shareholders without withholding tax or personal income reporting.

● Setting up a Dubai offshore company is cheaper compared to other UAE free zones

● Getting corporate bank accounts in a local Dubai bank is simple.

● Dubai company documents can be in either English or Arabic, which makes it easier for foreign owners to negotiate with finance houses, suppliers and investors.

● Owners don’t have to reside in Dubai. It is possible to register a company in a virtual location. This is not an option available in other parts of the UAE.

What are Dubai free zone company formation benefits

Companies that choose to set up shop in Dubai free zones can take advantage of a number of advantages. Among these advantages are:

- 100% foreign ownership is permitted in Dubai’s free zones, giving foreign investors total control over a company’s operations.

- Corporate and individual income taxes are not applied to businesses operating in Dubai free zones, making it a tax-friendly environment for commerce.

- Process simplification: The time and effort needed to launch operations are decreased by the streamlined and simplified nature of the company formation process in a Dubai free zone.

- Access to top-notch infrastructure: Dubai free zones are furnished with cutting-edge facilities and infrastructure, giving businesses a contemporary and effective working environment.

- Strategic location: Dubai’s location at the intersection of Europe, Asia, and Africa makes it the perfect place for businesses looking to enter these markets.

- Financial resources: Dubai free zones give businesses access to financial resources and investment opportunities, facilitating their ability to develop and expand their businesses.

Trusted by clients around the world

GBO is an official Dubai IFZA corporate services provider

FAQ

Is Dubai a special economic zone?

Free-trade zones in Dubai provide benefits of zero customs duty and company tax for foreign investors. There are around forty specialist free zones established in Dubai.

What are the established Free Zones in Dubai?

Like the top business setup companies in Dubai you can choose to set your operation up in a free zone that specialises in the area of business that is your focus.

There are 40 specialised zones, the most popular of which are:

- Free Zone Category

- Dubai Airport Free Zone Mixed-use

- Dubai Design District Creative Design

- Dubai Flower Center Flowers

- Dubai Gold and Diamond Park Extension of Jebel Ali

- Dubai Healthcare City Healthcare

- Dubai International Academic City Academic

- Dubai International Financial Centre Financial Hub

- Dubai Internet City Technology

- Dubai Maritime City Maritime Services

- Dubai Media City Media

- Dubai Multi Commodities Centre Commodity Trade

- Dubai Outsource Zone eCommerce and Support Services

- Dubai Production City Media

- Dubai Science Park Scientific Research

- Dubai Silicon Oasis Technology & Mixed-use

- Dubai South Artificial Intelligence and Futuristic Activities

- Dubai Studio City Media

- Dubai World Trade Centre Events and Conferences

- International Free Zone Authority (IFZA) Mixed-use

- International Humanitarian City Humanitarian Hub

- Jebel Ali Free Zone Mixed-use

- Meydan Free Zone Mixed-use

Which Dubai free zone should you select?

For your own specific business needs, deciding on which is the best business setup company in a Dubai free zone needs you to match your own business model with the type of free zone.

With the help of the GBO expert team it will be a simpler choice when you are setting up a Dubai free zone company, than if you try to select from the very wide and diverse list.

What is the benefit of establishing a company in a Dubai free zone?

Total foreign ownership is allowed, dividends can be repatriated without tax, complete exemption from import and export taxes, tax-free corporate profit and personal income.