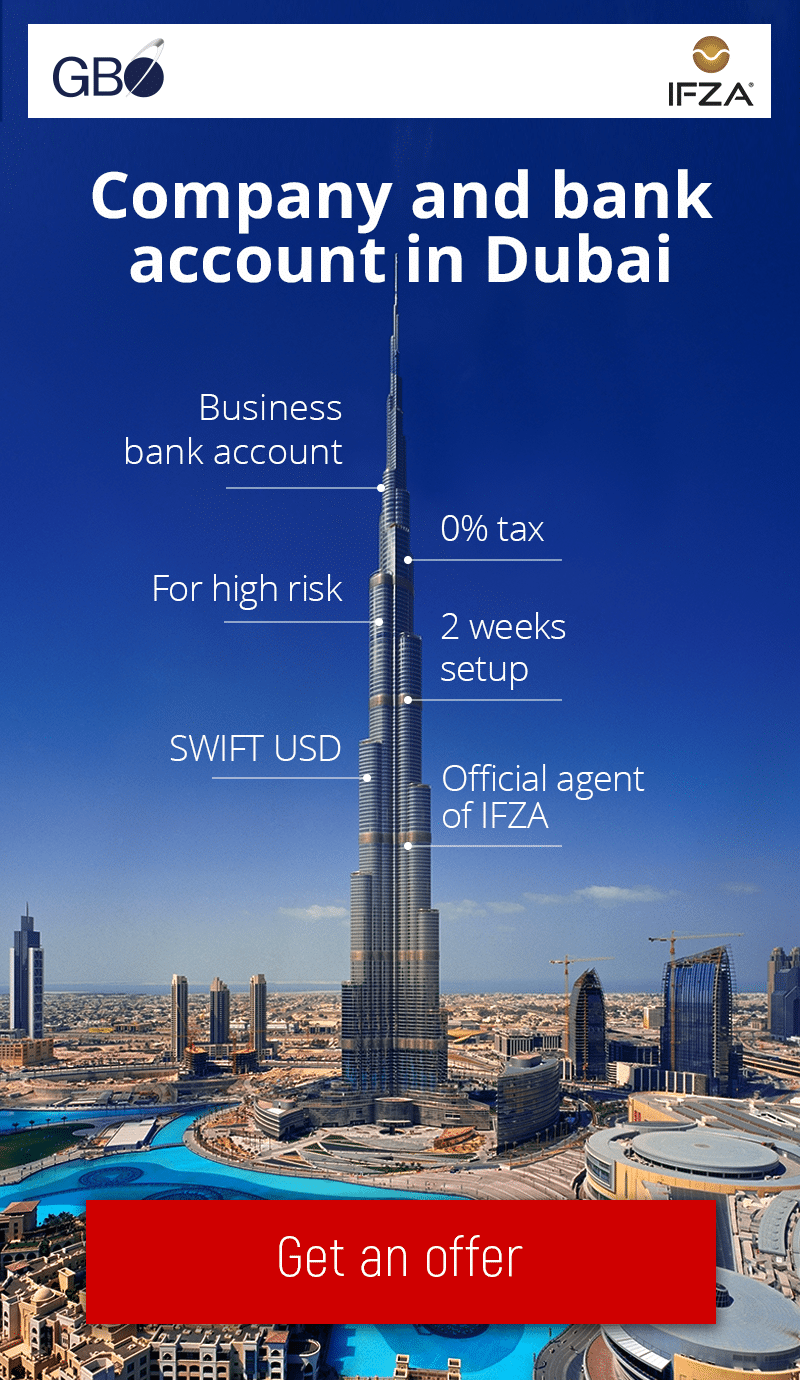

GBO is an Expert Consulting Agency for company formation and opening bank accounts in the UAE.

GBO is a consultancy firm that specializes in helping clients establish businesses and obtain bank accounts in the Dubai Free Zones of the United Arab Emirates (UAE).

We offer professional advice and support to negotiate the legal and regulatory requirements for starting up a business in the free zones because they are experts in IFZA – Dubai free zone firms.

GBO can assist you every step of the way to set up a successful business in the IFZA – Dubai free zone, whether you’re trying to launch a brand-new venture or grow into the UAE market.

Setup your AUE company with GBO AUE experts

GBO can help businesses establish companies and create bank accounts in the UAE, as well as help them understand and abide by the tax laws and regulations in the UAE.

The imposition of a federal Corporate Tax (CT) on corporate profits at a rate of 9% has been announced by the United Arab Emirates (UAE). For fiscal years beginning on or after June 1, 2023, this new tax system will go into force. This new tax is intended to assist the UAE in achieving its strategic objectives and to encourage companies to establish and grow their activities in the UAE.

Individuals and entities conducting business or engaging in commercial activity in the UAE, legal entities incorporated in the UAE, foreign entities managed and controlled from the UAE, foreign entities with permanent establishments or income derived from the UAE, unlimited liability partnerships, and unincorporated JVs are among those required to pay corporate tax. On business profits made by either natural or legal persons, the CT will be assessed.

Within nine months of the conclusion of the applicable Tax Period, tax returns and payments for the corporate taxare due. The Federal and Emirate Governments and their departments, fully-owned UAE companies that carry out a sovereign or mandated activity, companies involved in the extraction and exploitation of UAE natural resources, charities and other organizations that serve the public good, public and regulated private social security and retirement pension funds, and investment funds that satisfy certain requirements are all exempt from the corporate tax. The effect on free zones is that revenue produced by free zone entities will be taxed at a 0% CT rate, unless it originates from a branch of the entity on the mainland, in which case it will be taxed at 9% CT. created passive income

VAT issues in UAE for free zone companies

The imposition of a federal Corporate Tax (CT) on corporate profits at a rate of 9% has been announced by the United Arab Emirates (UAE). For fiscal years beginning on or after June 1, 2023, this new tax system will go into force. This new tax is intended to assist the UAE in achieving its strategic objectives and to encourage companies to establish and grow their activities in the UAE. Individuals conducting business or engaging in commercial activity in the UAE, UAE-incorporated legal entities, foreign entities managed and controlled from the UAE, foreign entities with permanent establishments or income from the UAE, unlimited liability partnerships, and unincorporated joint ventures are among the people and entities who must pay the corporate tax.

The corporate tax will only be applied to business profits made by natural or legal persons; other types of income, such as wages or personal income, will not be included. Within nine months of the conclusion of the applicable Tax Period, tax returns and payments for the CT are due. The Federal and Emirate Governments and their departments, fully-owned UAE companies that carry out a sovereign or mandated activity, companies involved in the extraction and exploitation of UAE natural resources, charities and other organizations that serve the public good, public and regulated private social security and retirement pension funds, and investment funds that satisfy certain requirements are all exempt from the CT.

The effect on free zones is that revenue produced by free zone companies will be taxed at a 0% CT rate, unless it originates from a branch of the entity on the mainland, in which case it will be taxed at 9% CT. Additionally, Mainland entities’ passive income will be taxed at 0% CT.

It is important to note that Free Zone businesses are handled differently when it comes to VAT; they are exempt from the tax as long as their supplies of goods and services are restricted to the free zone and not provided to the UAE’s mainland or to any other country. However, they will need to register for VAT and comply if they make any taxable supplies, import or export goods or services, or both.

It is important to remember that the UAE also imposes a Value Added Tax (VAT) in addition to the Corporate Tax. Free Zone businesses, on the other hand, are given a different treatment; they are exempt from VAT so long as their supplies of goods and services are restricted to the free zone and not exported to the UAE’s mainland or to any other country. However, they will need to register for VAT and adhere to the usual VAT regulations if they make any taxable supplies, import or export goods or services, or both.

Trusted by clients around the world

GBO is an official Dubai IFZA corporate services provider