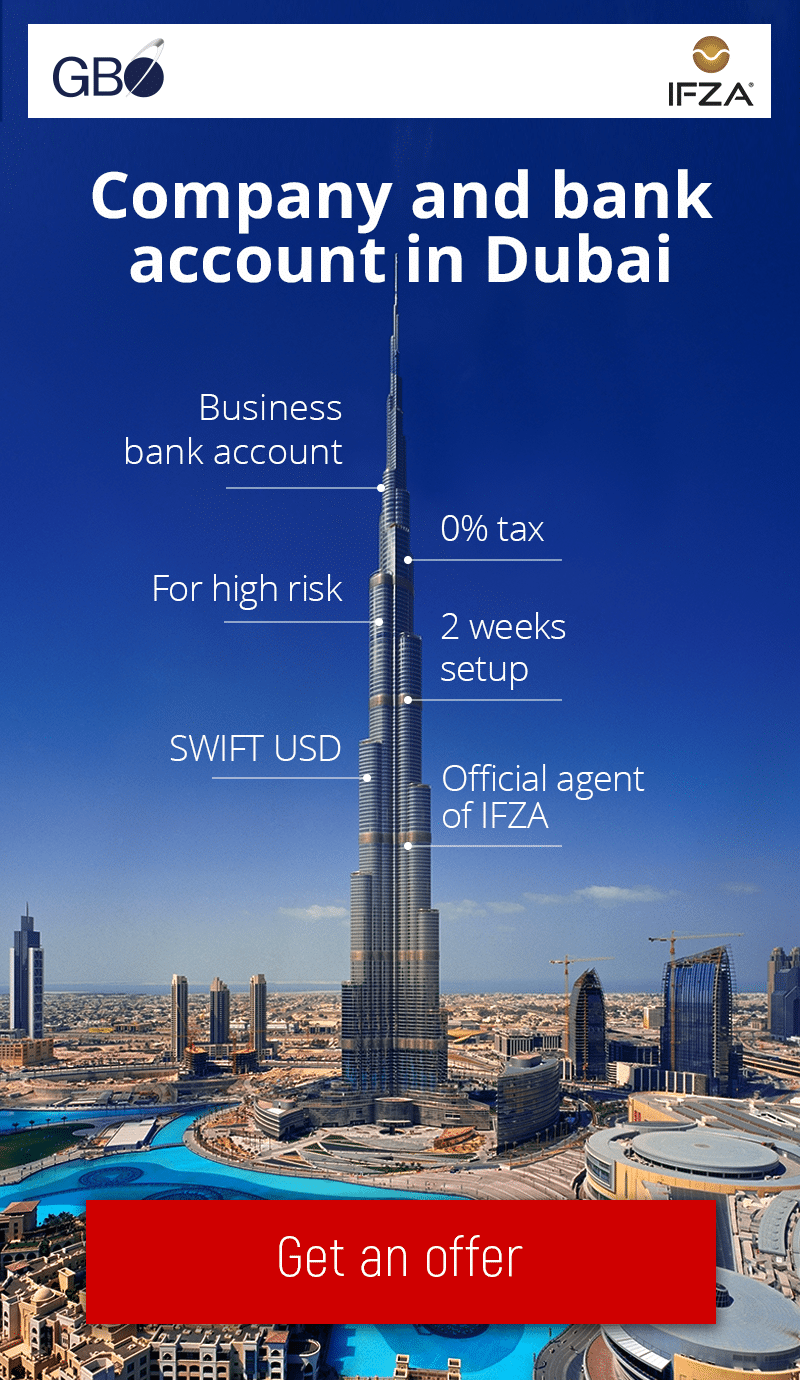

GBO is an Expert Consulting Agency for company formation and opening bank accounts in the UAE.

At GBO, we are a consultancy firm that specializes in assisting clients in establishing businesses and acquiring bank accounts within the Dubai Free Zones of the United Arab Emirates (UAE). Our team of experts in IFZA – Dubai free zone firms provides professional guidance and assistance to navigate the legal and regulatory necessities for starting a business in the free zones.

With GBO’s support, you can confidently establish a thriving business in the IFZA – Dubai free zone, whether you’re starting a new venture or expanding into the UAE market. We will be with you every step of the way to ensure a successful setup.

Setup your AUE company with GBO AUE experts

UAE as an offshore jurisdiction

Due to a number of factors, the United Arab Emirates and Dubai have emerged as popular locations to establish an offshore company. The simplicity of conducting business in the UAE is one of the primary factors. The nation boasts a stable legal system, robust infrastructure, and a business-friendly climate. In addition, the UAE’s advantageous location makes it simple to reach markets in the Middle East, Africa, and Asia.

The possibility to reduce tax obligations is one of the key benefits of establishing an offshore business in Dubai. Corporate taxes in Dubai are normally not levied on offshore companies operating in Dubai, which can be a big benefit for enterprises trying to pay as little tax as possible. Furthermore, Dubai has a low personal income tax rate, which is advantageous for employers and workers.

Utilizing Dubai’s advantageous location is another benefit of establishing an offshore business there. Dubai is a prime site for companies wishing to develop their operations in the Middle East, Africa, and Asia because it is a significant hub for trade and commerce in these countries. Additionally, Dubai is a desirable location for enterprises due to its solid legal system and well-developed infrastructure.

It’s crucial to keep in mind that foreign businesses cannot operate in the UAE while establishing an offshore corporation in Dubai. Only operations including trade, consulting, and management services, as well as retaining assets and investments, are permitted for offshore companies in Dubai.

Selecting the appropriate free zone is crucial when starting an offshore company in Dubai. It’s crucial to do your homework and pick the free zone that best matches the demands of your company because each one has its own set of rules and specifications. One of the most popular free zones for establishing an offshore business in Dubai is the International Free Zone Authority (IFZA), which provides a number of advantages, including 100% foreign ownership, 100% repatriation of capital and profits, and no corporate tax.

Overall, establishing an offshore company in Dubai can be a terrific method for foreign companies to grow their operations and benefit from the city’s favorable business climate and advantageous location.

Trusted by clients around the world

GBO is an official Dubai IFZA corporate services provider