Opening a business bank account in Dubai for non residents

When opening a business bank account in Dubai for non residents that is going to conduct business from there, whether it is a mainland operator that trades internally, is an offshore subsidiary of a foreign company, or is located inside one of the many free zones that can conduct business internationally, it is vital to set up an account with one of the commercial or digital banks that are based inside Dubai.

Dubai provides a booming business environment, with its physical location as a hub of global trade by air and sea. For these and other reasons, many investors have launched new ventures in the country.

Banks in Dubai provide excellent business banking services. It is possible with help from our team of consultants here at GBO to locate the perfect bank for your own specific business needs and to open all of the business banking channels quickly and cheaply.

Setup your Dubai company with GBO’s Dubai experts

in**@gb****.com

What are the benefits of having your business bank account in UAE bank?

A business bank account is needed to transfer funds, manage business cash flow, and control investments for any company established and active in Dubai.

The main functions of a business bank account in Dubai are:

- Cash flow management

- Credit

- Investment of assets

- Currency conversion

Cash flow management takes the form of accepting payments on behalf of the company and to meet regular business expenses through direct debit and credit card charges etc. UAE uses the same standard bank account identification system as the rest of Europe, known as the SWIFT identification. Another part of cash flow management by banks is in handling discounting of bills and to allow the company to make direct payments to employees for salaries, to suppliers for goods and services delivered to the company. Banks in Dubai also allow customers to receive Electronic Funds Transfer (EFT) payments from the company’s customers through merchant accounts and PPPs.

Bank credit may be extended by the bank secured by the company’s assets (inventory, property or cash that has been locked away in longer-term deposits), or by guarantees from shareholders or executives. Occasionally, a bank could agree to provide limited lines of credit without security for a specified time, but usually this will be at a much higher rate of interest.

Bank credit can be in the form of a deposit into the company’s current account, where it can be used in the same way as the ordinary cash balance, or it can be in the form of an overdraft facility, where the company’s account can go into minus.

Investment facilities provided by banks in Dubai cover equity investment in the local or international digital currency, bullion or stock markets as well as normal cash management such as short-term deposits of surplus cash, medium-term investment in bank deposit accounts etc.

Currency conversion for free zone corporations involves currencies other than Dubai dirham. As well, there is a growing need for companies to be able to do trade in digital currencies such as bitcoin, and the bank used by the company must be able to swap digital to digital, digital to fiat, fiat to digital and fiat to fiat.

Do UAE banks also provide secondary functions to customers?

Most UAE banks in UAE free zones also perform the usual range of secondary functions of a commercial bank such as acting as the customer’s agent to its customers for various services like bill collection, issuing bank-guaranteed cheques, paying periodic charges like insurance premiums, rent, loan repayments, instalments etc.

Banks can also be designated as legal representatives of the company for purchasing or redeeming securities in the stock exchange, claiming tax refunds, etc.

How to open a company bank account in Dubai

The criteria for opening a business bank account in Dubai differ between the cheapest Dubai free zones and the mainland, and also between bank to bank. It’s important that you review and become familiar with these stipulations before submitting an application.

Some of the eligibility rules are:

| Initial Deposit | If your company is a start-up with no history, many banks will require an initial deposit. Each bank has its own criteria. |

| Minimum balance | Some banks require a buffer as a positive balance, to protect themselves. This is more likely for new companies when owners are less well known in the bank |

| History of banking | Shareholders may be required to prove their liquidity by showing a solid banking history at reputable banks in other jurisdictions |

| Satisfying standard KYC rules | “Know your customer” is a standard set by SWIFT to protect financial institutions against fraud, corruption, money laundering and terrorist financing. |

| Proof of identity | A company operating in Dubai must be registered either as a mainland, offshore subsidiary or free zone entity. Banks can require proof of registration as well as of the identity of executives, shareholders and UBOs. |

How to open a corporate business bank account in Dubai

Once you have satisfied the above requirements, you can apply to your chosen bank to open a business account. Different rules for local presence apply. Mainland and setup company in Dubai free zone must have a registered office inside the country, but some free zones allow companies to either operate totally online from remote offices, or to rent virtual space “on the cloud” in a free zone. A mainland company requesting to open a commercial bank account in Dubai is required to be physically located in the country.

Opening a business bank account online in Dubai

Some banks allow fully digital online processing of new account applications. This involves filling out the required application form and submitting copies of all of the necessary documents via the internet, and conducting any follow-up interviews etc in digital meetings.

How to open a business bank account in Dubai for non residents

Local banks in Dubai have branches where you can meet an officer of the bank and be taken through the application process.

In both cases, for online and personal set up, we strongly recommend using the facilities offered by our specialist team who have lots of experience in the best way to conduct banking business in Dubai.

What documents are required to open a business account in a Dubai free zone?

- Copy of the trade licence issued by the free zone

- Certified copy of the company’s share certificate

- Certified copy of the Memorandum of Association and/or Articles of Association

- Certified copies of the passports and visas of all executives, partners and shareholders, with passport photographs

- If any physical space is rented (office, retail, warehouse), the tenancy agreement along with the Ejari contract

Optional, depending on whether this is a start up entity, and which free zone it is licenced in:

- Historical bank statement for the past six months for executives, partners and shareholders of a new company, or of the holding company if this is a subsidiary of either a UAE or foreign company

- Utility bills as proof of address

- For new companies – a business model or business plan, financial projections, company profile

- List of existing or prospective customer and suppliers

- Certified examples of the company’s invoices and receipts

How to open an offshore bank account in a Dubai free zone?

The minimum documentation required to open an offshore company in a Dubai free zone is:

- A certified copy of the company’s UAE Trade licence

- A certificate of good standing of the parent entity

- Details of the parent entity’s foreign banks

- CVs of all corporate signatories

- List of existing or prospective customer and suppliers

- Certified examples of the company’s invoices and receipts

In most cases, these documents are mandatory.

How long does it take to open a business bank account in Dubai?

Usually, banks will immediately open an account in your company’s name, but only so that you can deposit any stipulated minimum balance which guarantees the payment of all banking fees in case of rejection. No transactional business can be conducted until the account is formally opened. Depending on the specific details of your company and the kind of account you are applying for, the application may take anywhere from two weeks to several months. The bank will keep the account frozen with that minimum amount in the meantime.

Trusted by clients around the world

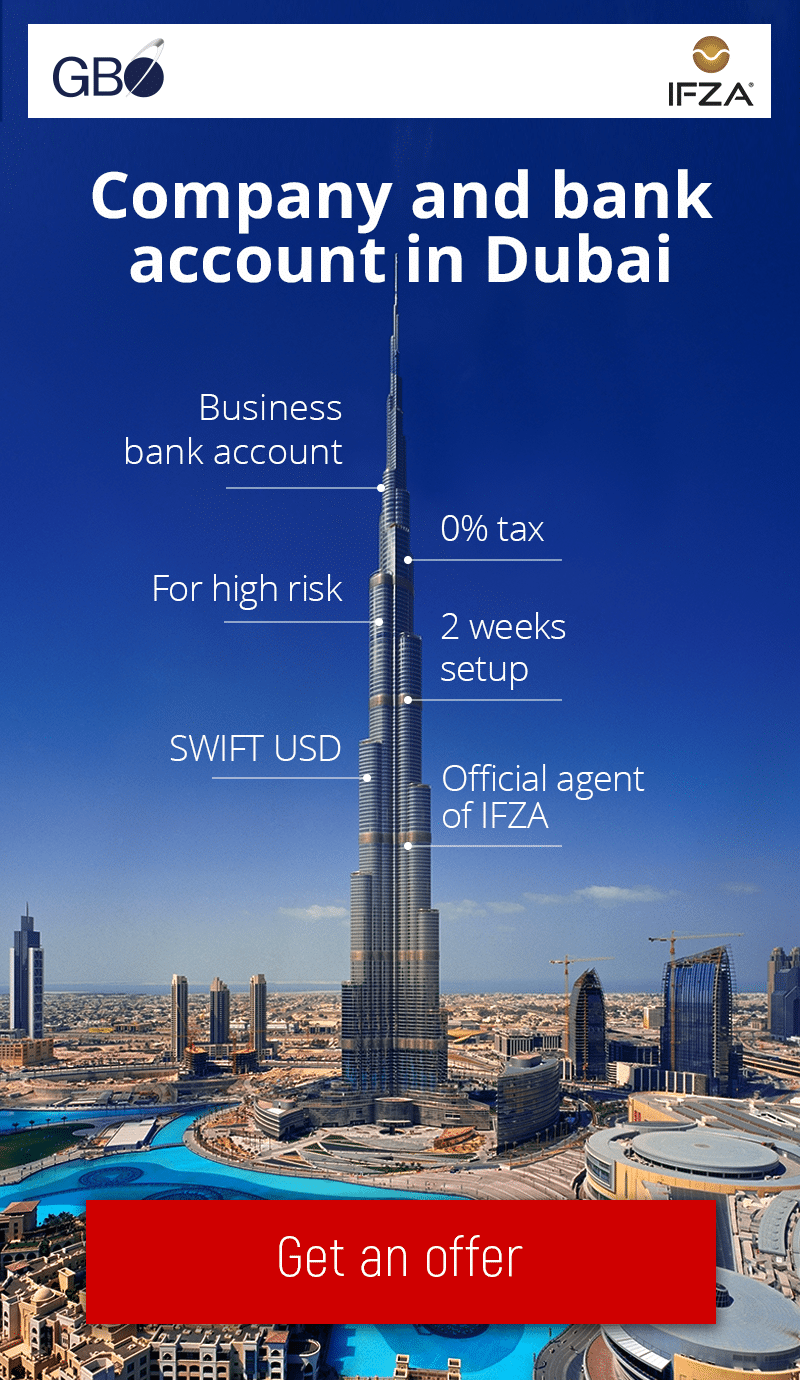

GBO is an official Dubai IFZA corporate services provider

FAQ

Which bank is best for company accounts in Dubai?

Some of the most popular banks that offer business accounts in to non-resident companies in Dubai are:

- Commercial Bank of Dubai (CBD) – My Business account

- Emirates NBD – Business banking

- Abu Dhabi Commercial Bank (ADCB) – Premium Current Account

- FAB – Business Advantage Account

- Abu Dhabi Islamic Bank (ADIB) – Business Elite Account.

Can I open a business bank account in Dubai?

A Dubai company registered as a Limited Liability Company and licensed for free zone or offshore trade, or a registered branch or subsidiary of another company in Dubai can open business accounts with local banks.

Requirements for a Commercial Bank of Dubai company account opening

When you are opening an account for a foreign-owned company in Dubai at the Commercial Bank of Dubai, you will need to give them a copy of your passport with the entry page stamped within the past six months. You require a certified transcript of a reference letter from your bank where you have a personal/corporate account in your country of origin.