In this document, we will talk about the basic requirements for opening a business bank account in the UAE and list the steps you need to take, and documentation you must have ready.

The UAE has a world-class banking system offering all of the latest facilities that a modern business needs. As well, the banks have strict rules to ensure that they are not subject to illegal activities such as money laundering or data theft.

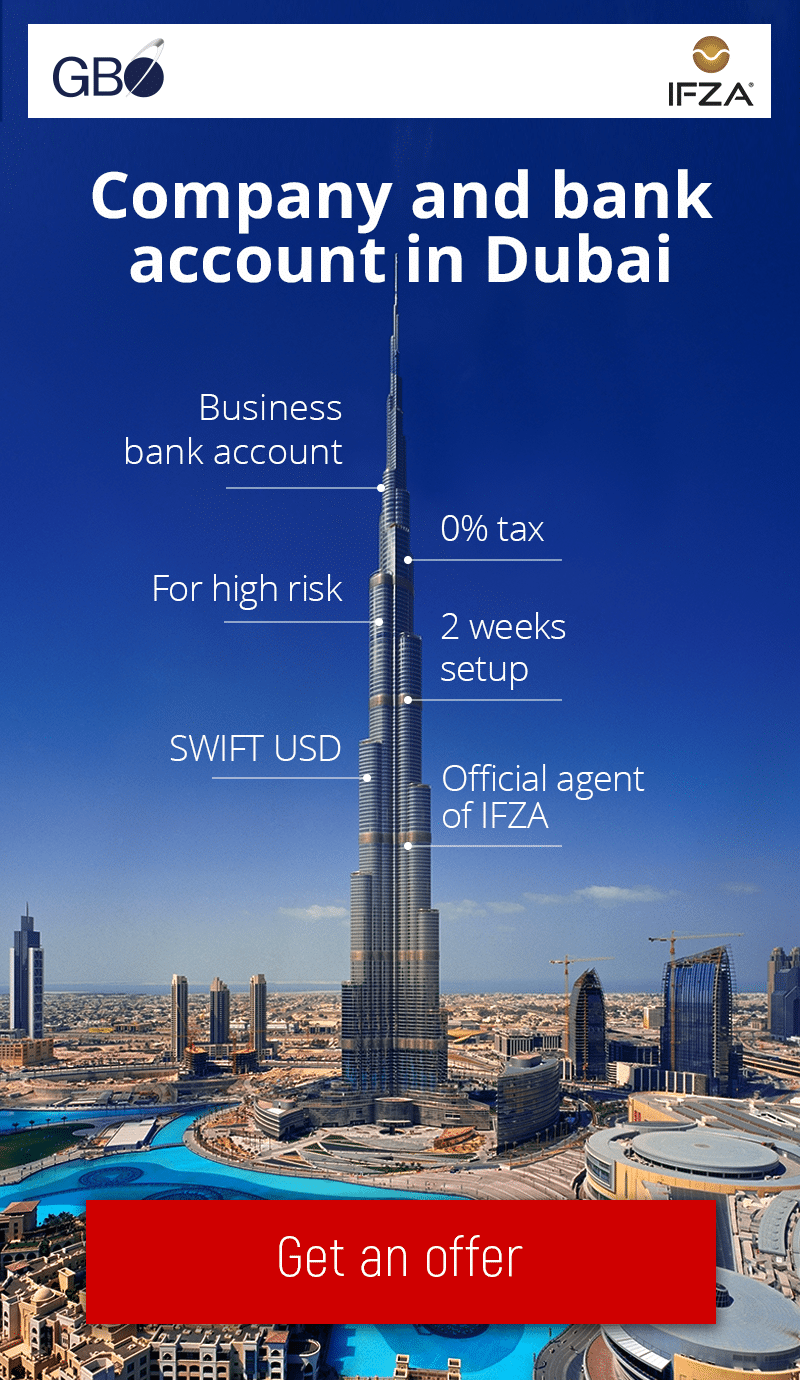

We suggest that you should use the knowledge and experience of our professional team of banking experts at GBO who know all of the ins-and-outs of the UAE banking system and how to open a business bank account in the UAE for non residents. We also have developed great relationships with local banks. With us at your side, the process of opening your account will be smoother and far more likely to succeed.

Setup your Dubai company with GBO’s Dubai experts

in**@gb****.com

When you are applying for a company bank account in the UAE, the options will depend on the choices you have made in the following basic ares:

- What kind of business is it: Mainland, free zone, or offshore

- Where is it located: Either in one of the Emirates, or in one of the more than 40 free zones that provide special tax benefits

- The type of incorporation: Sole owner, partnership or Limited Liability Company (LLC).

- Which bank you are applying to.

Security checks when you are opening a business bank account in the UAE for non-residents

Banks in the UAE apply standard Know Your Customer (KYC) and Anti-Money Laundering (AML) reviews. These include proof of each person’s identity and address, such as a certified copy of a passport, driver’s licence, bank statement or utility bill.

A company applying for a business bank account must be resident in the UAE. This can be a physical building in which the company owns or leases space, or a virtual office in one of the free zones. Documentation must be provided proving residence. In the case of a lease, it must include the mandatory Ejari contract.

How to open a business bank account in the UAE for non residents

A company can apply to open a business account in the UAE for non residents either through a bank’s online portals where the company applying for a bank account can fill in the required forms and submit digital documentation or by visiting one of the Banks’ branches or offices which has facilities where you can be interviewed by bank officers and submit the necessary forms.

Trusted by clients around the world

GBO is an official Dubai IFZA corporate services provider

FAQ

How long does it take for opening a business bank account in a UAE free zone?

With the professional advice of our expert consultants here at GBO, this can be done in about two weeks to one month. We can’t guarantee this, because your application will be subject to the bank’s compliance check and management approval.

What are the requirements for opening a business bank account in a UAE free zone?

The process of opening a business bank account in a UAE free zone will depend a lot on which free zone you have chosen as your base. In the International Free Zone Authority (IFZA) in Dubai, there are many banks providing up-to-date and modern banking and financial services, such as Commercial Bank of Dubai (CBD), Noor Bank, Emirates National Bank of Dubai (ENBD), Abu Dhabi Commercial Bank (ADCB), and Mashreq Bank.

What are the documentary requirements for opening a business bank account in the UAE?

There is a basic list of the documents you will need to apply for an account. It is important to note that this list varies depending on the extent of each client’s business and the bank’s criteria as per the type of corporate account you want to open.

If you are setting up a mainland company, the documentation requirements for the bank account will be more extensive than the requirements for opening a business bank account in a UAE free zone. Mainland company bankers will require, in addition to the above, the UAE VAT certificate, a list of current tenders or contracts with UAE government bodies or corporations and any other information they deem necessary.

For a free zone company, the basic document requirements are:

- A certified copy of the trade licence issued by the free zone

- A certified copy of the of the company’s share certificate

- A certified copy of the of the Memorandum of Association and/or Articles of Association

- Certified copies of the passports and visas of all executives, partners and shareholders, with passport photographs

- If any physical space is rented (office, retail, warehouse), the tenancy agreement along with the Ejari contract

- A copy of the board resolution empowering the applying company executive to open the account and act as signatory.

Offshore companies, which are subsidiaries of foreign corporations, must submit additional information regarding the parent company because they intend to open a business bank account in UAE for non residents. Document such as a certified copy of the company’s UAE trade licence, a certificate of good standing of the parent company, details of the parent’s foreign banks, CVs of all corporate signatories, a list of existing or prospective customers and suppliers and tenders or contracts with UAE government bodies or corporations may be needed