GBO is an Expert Consulting Agency in the UAE: Helping Businesses Achieve Their Full Potential

Setup your AUE company with GBO AUE experts

Ranked by the World Bank as #16 in ease of doing business, the United Arab Emirates comes ahead of many advanced top-ten economies like Canada and Germany. For ease of establishing a startup enterprise, it rates better than “hot” countries in the EU like Latvia and Estonia.

The United Arab Emirates consists of seven separate states with their own individual rulers and governments, grouped in a federation with a central government. The seven emirates are Abu Dhabi, Ajman, Dubai, Fujairah, Ras al-Khaimah, Sharjah, and Umm al-Quwain. The national currency is the UAE dirham, and the conversion rate is roughly 4 dirham = 1 euro. According to the World Bank, the population in 2021 was approx. 10 million and GDP in 2020 was $358.9 billion.

At the same time as it remained true to its culture and traditions, UAE introduced full equality for women in business and government, job growth for citizens and residents, advanced healthcare and education for all citizens.

With the tremendous flow of revenue from its reserves of oil and gas, the UAE has been transformed into a world-class economy. The population has grown from around four million in 2005 to roughly ten million in 2020, of whom about 88% are residents with visas and their families. Dubai is home to nearly 36% and Abu Dhabi to 17% of the total population, The UAE has a unique population structure. Most resident workers coming from India, Pakistan, Bangladesh, Egypt, and the Philippines are engaged in construction, transport and storage, and accommodation sectors. The UAE has one of the lowest unemployment rates in the world, currently standing at just 2.2%.

How do the individual Emirates rank for ease of business?

Dubai provides foreign investors with a wide variety of commercial prospects and has the most advanced economy in the UAE. Its image is as the home of business in the UAE. Dubai is a global center for technology and business.

Companies can find collections of buildings clustered around a park in specialised free zones that offer unique advantages to foreign investors. Free zones like the International Free Zone Authority (IFZA) in Dubai allow 100% foreign ownership. Outside of these zones, it may be required that a local resident holds a majority stake in the company and acts as a sponsor for the required visa.

.

The International Free Zone Authority (IFZA) is one of the most highly sought-after free zones in Dubai where people work, play and live. The main sectors are trade and consulting in IT, high-tech and engineering.

Dubai also includes the Dubai Digital Park, which offers flexible office accommodation starting at just 50 square metres, which can go all the way up to 10,000 square metres, fully integrated with smart services.

Abu Dhabi is the administration capital of the UAE and also one of the main economic centres. The Abu Dhabi Investment Authority is now the fifth-largest sovereign wealth fund in the world, with vast reserves of gold and foreign currency assets.

The largest free zone is the Abu Dhabi Airport Free Zone (ADAFZ) which is a business park close to Abu Dhabi International Airport. It provides comprehensive commercial business, offices and warehousing services. Plots of land can be bought by investors for development of logistics services.

In Abu Dhabi, the Ras Al Khaimah free zone has more than 12,000 companies in over fifty different sectors that investors coming from over 100 countries have started.

GBO can help you when you are starting a business in the UAE

GBO’s team of expert consultants will take you step-by-step through the process of setting up a company in the UAE. We are also able to assist with applications for visas.

Depending on the kind of business, your nationality, and the country of your parent company if you are opening a subsidiary, there are some differences between the corporate requirements.

We strongly advise getting professional help from consultants at GBO to take you right through the processes, which include

- Selecting the type of corporate entity (partnership, sole trader, LLC).

- Registering a unique business name.

- Applying for the business licence.

- Applying for visas for yourself, any employees or family members

- Renting virtual or shared office space.

GBO is here to help you with all of these steps, to get approvals, get your licence and register your company.

What makes the UAE the ideal Business Centre for investors?

The UAE for years has been using their vast income from oil and gas to develop a well-regulated and stable business environment. The goal is to sustain the economies when oil revenues start to drop and boost the country’s long-term prosperity and appeal to foreign investors.

The long-term investment has focused on these facilities :

Modern infrastructure : The UAE now has one of the most advanced power and telecommunications infrastructures in the world.

Transport : The UAE is now a leading regional and international transport hub. It currently ranks #3 outside of the US and EU, just behind Hong Kong and Singapore

Trade : A vast potential global market for a diverse range of goods and services.

Banking : The UAE has a full range of banking service providers, including its traditional “street front” retail banks and newer digital banks and EMIs.

Exhibition and conference facilities : Each emirate has a specialised and highly advanced exhibition facility. These include:

- Dubai World Trade Centre is the largest event and exhibition centre in the Middle East and is UAE’s leading event venue.

- Dubai International Convention & Exhibition Centre Dubai International Convention & Exhibition Centre

Healthcare and hospitals : The UAE has one of the top healthcare systems in the world ranked in the top ten most efficient healthcare systems in the world. There has been unprecedented growth in medical tourism to the UAE, but for non-citizens, it can be expensive. Citizens enjoy a government-funded healthcare system. The same healthcare levels are available to non-residents, but at extra cost. English is widely spoken and understood in private healthcare facilities, since the majority of the healthcare providers are foreigners or trained overseas.

Dubai employers can make use of the national Essential Benefits Plan (EBP) which is the equivalent of UAE public healthcare. However, EBP is only available to employees earning less than approx. 1300 euro per month or less. Since most domestic workers will not qualify, it may be necessary to provide healthcare for them.

Education and schools : The UAE has attracted major universities from all over the world to open campuses and offer tertiary education to both citizens and foreigners. These include the United Arab Emirates University (UAEU) with more than 14,000 students, and four Higher Colleges of Technology (HCT).

In free zones, there are designated educational institutions such as Dubai International Academic City and Dubai Knowledge Village.

How do foreign-owned companies operate in the UAE?

It is possible to rent office space in any one of the 40 free zones in Dubai or other Emirates.

Companies can be set up by foreign investors in a free zone tax haven. For such companies, there is no customs or sales levy, zero tax on profit and dividends paid to shareholders. This makes the UAE a highly sought-after location for new enterprises which can earn better returns on their capital.

Trusted by clients around the world

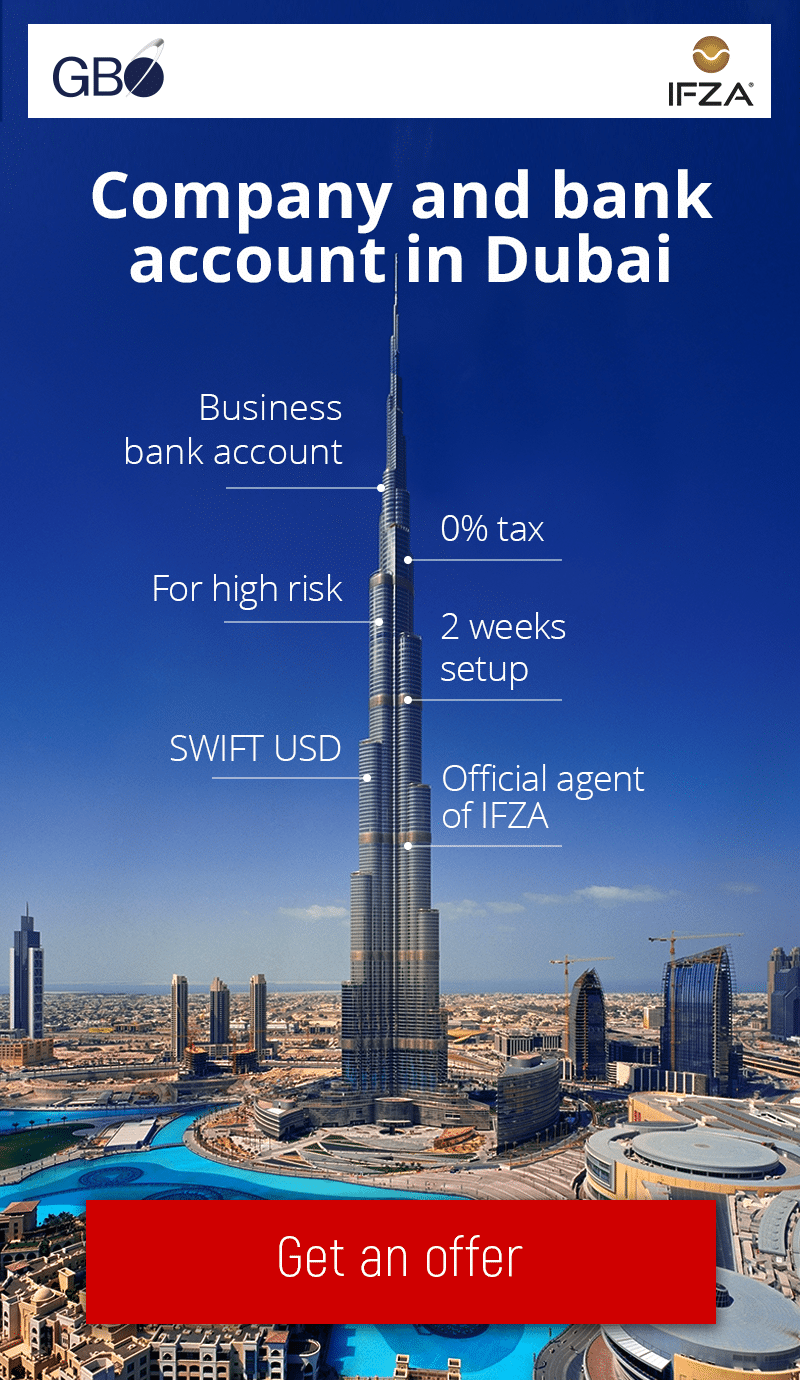

GBO is an official Dubai IFZA corporate services provider

What is the best free zone in the UAE?

The main benefits for companies in UAE to set up offshore operations are:

- 100% foreign ownership is allowed

- Exemption from all corporate and income taxation

- Full repatriation of the profits and capital is allowed

- Purchase of properties in approved areas of the Emirate is allowed

- No requirement to rent or purchase physical premises.

- Easy registration and documentation

- No annual audit required

- Low setup and operation costs

GBO is a business setup consultants in Dubai and one of the top incorporators in Dubai, associated with IFZA. We have a team of experienced business consultants that is always ready to assist you with all aspects of business setup in the UAE.

FAQ

Which is the cheapest trade licence in UAE?

In Dubai, the International Free Zone Authority (IFZA) has the cheapest trade licence in the UAE and requires a visa.

What is the cost of a trade licence in Dubai?

An offshore company licence in Dubai that can operate anywhere in the United Arab Emirates will cost between 7,000 to 10,000 euros. The cost will vary, depending on a number of factors, such as the free zone in which it is registered, the corporate structure (sole trader, partnership or LLC) etc.

Which is the cheapest free zone licence in the UAE 2023

The most important choice for an investor to make is whether the free zone suits the company’s needs, in terms of the areas of business you are allowed to operate in, the facilities offered by the free zone, the visa requirements and much more. In Dubai, there are more than 40 separate free zones, and the costs vary by hundreds of percent.